Analysis: CLEAN Future Act's Clean Energy Standard Is Designed To Fail

An independent analysis of the CLEAN Future Act (H.R. 1512) finds that its provisions intended to phase out fossil-fueled electricity production by 2035 are dangerously flawed.

An independent analysis of the CLEAN Future Act (H.R. 1512) finds that its provisions intended to phase out fossil-fueled electricity production by 2035 are dangerously flawed.

The so-called Clean Electricity Standard in Title II of the legislation establishes a cap-and-trade system of “zero-emission electricity” tradable credits for electricity generators. The cap of allowances for greenhouse-pollution-emitting electricity declines until 2035, when all electricity is meant to be “zero-emission,” a definition which encompasses renewable and nuclear energy.

In “Review of the Credit Trading System in Title II of the CLEAN Future Act,” Bruce Buckheit, a former director of the EPA Air Enforcement Division, finds that the system “is flawed to the point that it is unlikely to achieve zero emission electricity from the power sector by 2035.”

Specifically:The CLEAN Future Act draft (dCFA) defers any serious disincentives for gas-fired generation until 2031 and then hopes to replace all of the growing gas-fired electric generating unit (EGU) fleet with renewable energy (RE) over a short 4-year period. This is not feasible and sets itself up for failure.The starting baseline for “Zero Emission Electricity” (ZEE) requirements is based on the 2017-2019 generating mix. This ignores ongoing retirements of coal plants and RE capacity that is under construction today and will be online in 2023. The consequence is a large initial surplus of ZEE, disincentivizing necessary early investment in non-fossil fuel energy.

He expects that “gas-reliant regions, such as the Northeast U.S., might not have to take any significant action until 2031.”

Furthermore, Buckheit finds that the legislation as written doesn’t even require “zero-emission” electricity, but instead “permits generation at less than 0.4 mt (882 lb) CO2e/MWh.”

He also notes that, given regulatory timelines, the “trading system cannot begin to operate in 2023 as the draft bill contemplates.”

Environmental Defense Fund Board Members Actively Invest in Fracking

Environmental Defense Fund (EDF), unlike some other environmental groups which support a ban on fracking, argues that natural gas extraction can be done responsibly, perhaps reflecting the views of board members profiting from active fracking investments.

Environmental Defense Fund (EDF), unlike some other environmental groups which support a ban on fracking, argues that natural gas extraction can be done responsibly, perhaps reflecting the views of board members profiting from active fracking investments.

“Hydraulic fracturing isn’t all good, but it doesn’t have to be all bad, either,” an EDF blog post summarized in May of this year.

The organization’s top natural gas official, vice president Mark Brownstein, responded to this week’s New York state ban on hydraulic fracturing with an ambiguous statement:“The risks associated with hydraulic fracturing and unconventional oil and natural gas development are so serious, EDF believes that every state has the right to decide whether or not development is consistent with the interests and wishes of its citizens. New York State has made its decision—but with or without drilling here, New York remains the country’s fifth largest natural gas consumer, with an extensive network of gas transmission and distribution lines. Methane leaking from these systems has more than 80 times the climate-warming power of carbon dioxide over a 20-year timeframe. State officials and the companies that operate these pipes need to find and fix those leaks as part of the ongoing effort to modernize New York’s electric and gas infrastructure and accelerate the state’s transition to cleaner, renewable, and more efficient energy.”

EDF’s approach to environmentalism is pro-market, built upon investment strategies and corporate partnerships. The organization has partnered with dozens of companies in the natural gas industry for a suite of studies on methane leakage from fracking, storage, and distribution.

Meanwhile, several members of EDF’s board of trustees, who provide millions in funding for the organization, are actively invested in fracking. (This is far from unique among environmental non-profits.)

The board member with the strongest conflict of interest is Edward Stern, an active investor in fracking and a direct funder of pro-fracking front groups in New York, although he is not the only problematic trustee.

Edward Stern is the founder of Hartz Capital, which focuses “on the acquisition of properties for the development of oil and gas in emerging shale plays.” Hartz owns shale gas leases in upstate New York and funded the pro-fracking front group Clean Growth Now.

Trustee Kristine Johnson is wife of Tim Dattels, of TPG Capital. In 2007, TPG Capital was part of a consortium that purchased TXU Corp for $48 billion, and closed several high-pollution coal plants, a move touted by an actively involved EDF. That investment is now effectively worthless, in part because of the fracking boom.

However, TPG has also poured billions into successful fracking investments. In 2011, TPG Capitol formed Maverick American Natural Gas, a fracking company, with Hughes and Hart. In 2013, TPG sold its stakes in tar-sands and shale-oil refiner Northern Tier Energy (in which TPG had invested about $200 million in 2010), natural gas pipeline giant Copano Energy (in which TPG invested $300 million in 2010), and fracking equipment company Valerus Field Solutions (in which TPG had invested $500 million in 2009). In February 2014 TPG announced it was building a new $1.25 billion fund to invest in similar companies. In March of this year Maverick acquired $1.8 billion worth of active fracking wells in Wyoming’s Jonah field from the Canadian oil and gas giant Encana.

Hedge-fund billionaire Julian H. Robertson, Jr., who bankrolled the 2012 Mitt Romney run, is also an active fracking investor. The 80-year-old has been one of EDF’s largest donors, putting in over $60 million to support EDF’s cap-and-trade push during the 2000s. Robertson is now mostly retired, but is an advisor to Tiger Infrastructure Partners, a fund formed in 2009 with over $500 million invested in “midstream oil and gas fracking companies in a joint venture with Kiewit.

There are also several trustees with smaller but meaningful investments in the fossil-fuel industry.

Trustee Susan Mandel is the wife of Stephen Mandel, whose Lone Pine Capital has holdings in the liquid natural gas giant Cheniere Energy.

Trustee G. Leonard Baker, Jr. is a partner in the Silicon Valley venture capital firm Sutter Hill Ventures, whose holdings include Chengwei Capital, which invests in oil & gas ventures in China.

Trustee Ann Doerr is the wife of Kleiner Perkins Caulfield Byers venture capitalist John Doerr. Most of Kleiner Perkins’ energy investments are in the clean tech space, but it has some “cleanish” fossil-fuel investments as well. Portfolio company Luca Technologies “owns and operates wells and infrastructure, then sells natural gas into existing markets,” and portfolio company GreatPoint Energy does coal-to-gas conversion.

EDF’s board also includes two scions of influential conservative families—Sam Rawlings Walton, grandson of Sam Walton, and Kathryn Murdoch, daughter-in-law of News Corp’s Rupert Murdoch.

Interestingly, Katherine Lorenz, the granddaughter of George Mitchell, the “father of fracking,” is on the board.

In Upstate Ad, Pro-Fracking Clinton Promises To 'Stand Firm With New Yorkers Opposing Fracking'

In an unannounced climate-change ad running in upstate New York, the Hillary Clinton campaign declares allegiance with the anti-fracking movement, despite the candidate’s support for fracking. With images of dirty rigs and anti-fracking protest signs, the narrator promises that a President Clinton will “stand firm with New Yorkers opposing fracking, giving communities the right to say no.”

Watch:

The ad’s characterization of Clinton’s stance on fracking is technically accurate, though misleading, as Clinton will cede localities control over fracking, while supporting natural gas as a ‘bridge fuel’. One could say that Clinton will “stand firm” with other states supporting fracking, such as Wyoming, Oklahoma and Pennsylvania. Clinton has not taken a position on the Constitution Pipeline, a controversial fracked-gas pipeline being constructed through upstate New York from Pennsylvania. Clinton is on record supporting “new natural gas pipeline investment.”

Her opponent, Bernie Sanders, unequivocally opposes fracking nationally.

The television ad also credits Clinton’s work at the failed Copenhagen climate talks for “laying the groundwork” for the Paris climate agreement. The ad confusingly displays a photo of Clinton at Copenhagen under a Washington Post headline about the Paris talks six years later.

The ad began running in upstate New York communities on Wednesday, April 13, six days before the April 19th primary. It has aired over 200 times cumulatively on Albany, Rochester, Syracuse, Watertown, Elmira, Binghamton, and Utica stations.

The ad was not announced to the press by the campaign, allowing it to avoid scrutiny by fact-checkers or the public. Following New York, the election heads to Pennsylvania, where fracking is allowed.

Transcript:

NARRATOR: China. India. Some of the world’s worst polluters. As secretary of state, Hillary Clinton forced them to the table, making real change by laying the groundwork for the historic global agreement to combat climate change.As president, she’ll invest in a clean energy future, and the jobs that go with it. And stand firm with New Yorkers opposing fracking, giving communities the right to say no. Because our future depends on getting this right.

CLINTON: I’m Hillary Clinton, and I approve this message.

Fracking-Fund Billionaire Marc Lasry is a Top Clinton Advisor and Fundraiser

Marc Lasry and Hillary Clinton

In 2014, Lasry, founder and chair of Avenue Capital Group, raised $1.3 billion for a fund that bought loans of distressed energy companies, only to watch the debt become even more worthless. $200 million raised for the Avenue Energy Opportunities Fund came from the Pennsylvania Public School Employees’ Retirement System. Lasry has shrugged off the losses, confident the good times will come again for the frackers.

“There’s going to be a huge turnaround on energy,” Lasry told reporters this January. The oil and gas slump has hurt exploration and production companies, but prices “will always come back. The question is, does it take six months or does it take three years?”

Meanwhile, Marc Lasry—a co-owner of the Milwaukee Bucks—has become a top contributor and bundler for the 2016 Hillary Clinton campaign. When Clinton announced her campaign, Lasry emailed his friends looking to quickly raise $270,000 with ten maxed-out contributions of $2700 each.

“It’s been a long time coming, and now there’s a huge amount of excitement behind her,” Lasry told Bloomberg News. “You will start seeing it in the numbers as people start donating.”

The exact amount of money bundled by Lasry has not been publicly disclosed; the Clinton campaign only discloses which bundlers have raised over $100,000.

“She’s moving a little bit to the left, and I think that’s fine,” Lasry told Bloomberg in May 2015, after hosting one her first campaign fundraisers at his townhouse. “People who are giving money to her understand that. Obviously, some people have some issues. I think the vast majority won’t have issues.”

On February 12 of this year, Clinton came out in favor of new domestic natural-gas fracking and pipeline infrastructure.

Marc Lasry has deep financial and familial ties to the Clintons and Obamas.

Lasry’s daughter Samantha was a Congressional intern for Rahm Emanuel in 2005, the future chief of staff for Barack Obama. Meanwhile, Lasry donated to Rahm’s campaign.

In 2006, Marc Lasry hired Chelsea Clinton to work at his hedge fund, Avenue Capital Group, while Hillary Clinton was Senator of New York. Meanwhile, Lasry contributed to Hillary Clinton’s campaign.

Marc Lasry was a top contributor and bundler for Barack Obama in 2008 and 2012. Meanwhile, Alexander Lasry, his son, was a special assistant to Valerie Jarrett in the Obama White House from 2010 to 2012.

In 2011, Marc Lasry and Goldman Sachs CEO Lloyd Blankfein invested in Eaglevale Partners, the hedge fund set up by Marc Mezvinsky, Chelsea Clinton’s husband. Lasry invested $1 million. The fund “underperformed.”

Oddly enough, Lasry was also one of Donald Trump’s top investors: he managed the bankruptcy buyout of Trump’s casinos in 2010. He then served as the chairman of Trump Entertainment Resorts, Inc. from 2011 to 2013, with a 22 percent stake and managerial control of the Trump Plaza, Trump Marina and Trump Taj Mahal casinos.

In the same interview this January where Lasry bet that the oil and gas industry would rise again, he expressed similar confidence about his chosen candidate.

“Hillary is going to be the next president of the United States.”

Bernie Sanders: 'Hillary Clinton Supports Fracking. I Do Not.'

“Hillary Clinton supports fracking. I do not.”

“Hillary Clinton supports fracking. I do not.”

These words appeared in a recent fundraising email from Democratic presidential candidate Bernie Sanders, which fiercely attacked fracking and Hillary Clinton’s support from and for the natural gas industry.

In blunt language, Sanders contrasted his call for a national moratorium on fracking against Clinton’s fundraising from natural gas investors:Just days before the Iowa caucus, Hillary Clinton left the campaign trail for a high-dollar fundraiser at a hedge fund. That same hedge fund is a major investor in fracking, an incredibly destructive practice of extracting natural gas by pumping hundreds of secret chemicals into the ground.

Hillary Clinton supports fracking. I do not.

And just as I believe you can’t take on Wall Street while taking their money, I don’t believe you can take on climate change effectively while taking money from those who would profit off the destruction of the planet.

Sanders’ email comes on the heels of the Clinton campaign’s February 12th release of a policy promoting new natural-gas extraction and infrastructure. Clinton’s promotion of “safe and responsible natural gas production” (the phrase “safe and responsible” was used five times) was praised by LiUNA, a trade union that had vigorously supported the construction of the Keystone XL pipeline.

“Domestically produced natural gas can play an important role in the transition to a clean energy economy,” Clinton’s policy position states, making no mention of the candidate’s February 4th pledge, caught on camera, to ban the extraction of fossil fuels, including natural gas, from public lands.

The conflict between Sanders and Clinton on natural gas is set to become a point of major political contention, as voters go to the polls next month in states overrun by fracking, including Oklahoma and Texas on March 1, Kansas and Nebraska on March 6, and Ohio on March 15. These states are reeling from the boom and bust of the fracking industry, left with earthquakes, degraded water supplies, and thousands of non-union workers exploited and poisoned by the private fracking companies Clinton’s donors have financed. Fights over natural-gas pipelines and facilities have mobilized activists in dozens of other states.

On a national scale, a growing body of scientific evidence is building that the climate benefits of switching from coal to natural gas were a total mirage, with the catastrophic Porter Ranch methane blowout the most visible and extreme example of a nationwide surge in methane leakage as a result of the domestic fracking boom promoted by the Bush and Obama administrations. Methane is a greenhouse gas that is 80 times more potent than carbon dioxide on a twenty-year timespan.

Read Sanders’ full email:

Sisters and Brothers -Just days before the Iowa caucus, Hillary Clinton left the campaign trail for a high-dollar fundraiser at a hedge fund. That same hedge fund is a major investor in fracking, an incredibly destructive practice of extracting natural gas by pumping hundreds of secret chemicals into the ground.

Hillary Clinton supports fracking. I do not.

And just as I believe you can’t take on Wall Street while taking their money, I don’t believe you can take on climate change effectively while taking money from those who would profit off the destruction of the planet.

Please contribute to our campaign right now to help elect a president who isn’t beholden to special interests that profit off of pollution.

Dick Cheney pushed through changes to the Safe Drinking Water Act that legalized fracking, despite the fact that fracking companies keep the chemicals they pump into the ground a secret.

People who live near fracking locations no longer have drinkable water, and in some cases their tap water is actually flammable. Oklahoma has even seen a rash of earthquakes that many believe are a result of fracking.

In short, fracking is a disaster for the planet.

We need a president who is not beholden to special interests and who will do everything in his or her power to fight the effects of climate change. It’s clear that to elect that kind of president, millions of people need to come together and chip in whatever they can.

Make a contribution to our campaign now to send a message that you want to elect a president who will do everything possible to fight climate change.

We can’t afford to let people who would destroy our planet elect our next president.

Thank you for your support.

In solidarity,

Bernie Sanders

Clinton Goes to Pennsylvania to Reap Windfall from Pennsylvania Frackers

Clinton has avoided taking any clear stand on fracking. While she has embraced the Clean Power Plan, which assumes a strong increase in natural-gas power plants, she also supports a much deeper investment in solar electricity than the baseline plan. The pro-Clinton Super PAC Correct the Record, run by David Brock, touts Clinton’s aggressive pro-fracking record.

Numerous grassroots groups have risen to oppose the toxic fracking of Pennsylvania and its labor abuses, including Marcellus Protest, No Fracking Way, Pennsylvanians Against Fracking, Keep Tap Water Safe, Stop Fracking Now, and Stop the Frack Attack.

As reported by the Intercept’s Lee Fang, “One of Franklin Square Capital’s investment funds, the FS Energy & Power Fund” the Intercept’s Lee Fang reports, “is heavily invested in fossil fuel companies, including offshore oil drilling and fracking.” The company cautions that “changes to laws and increased regulation or restrictions on the use of hydraulic fracturing may adversely impact” the fund’s performance.

Through its fund, Franklin Square invests in private fracking and oil drilling companies across the nation, as well as Canada and the Gulf of Mexico. This includes heavy investment in Pennsylvania frackers.

Franklin Square companies in the Pennsylvania fracking industry

- Ameriforge Group

- Atlas Resource Partners

- Cactus Wellhead

- Calpine

- Chief Oil & Gas

- Cimarron Energy

- Crestwood

- Dynegy

- Eclipse Resources

- EV Energy Partners

- Exterran Partners

- Gardner Denver

- Global Partners

- Gruden Acquisition

- Kenan Advantage Group

- Moxie Liberty

- Murray Energy Corp

- PeroxyChem

- Vantage Energy

- Warren Resources

- Zachry Holdings

Bold indicates a company that runs fracking wells in Pennsylvania (Eclipse Resources is a Pennsylvania-based company with fracking operations in Ohio). The other companies listed are industry service companies with business in Pennsylvania, including pipelines, trucking, chemicals, and power plants. Murray Energy runs coal mining operations in Pennsylvania.

Tickets to the event ranged from $1,000 to $27,000. Contributors at the $2,700 level got a photo taken with Clinton, and the $27,000 contributors were afforded the opportunity to meet and hear Jon Bon Jovi perform an acoustic set.

Fracking Opponents Rack Up Victories in Local Battles

This Election Day, opponents of the hydrofracturing boom achieved a number of local ballot victories, overcoming massive spending by the fossil-fuel industry.

- Voters in Denton, Texas, the “birthplace” of the modern fracking boom, banned fracking in a landslide vote. Supporters of the ban were outspent by the oil-and-gas industry ten to one.

- Athens, Ohio voters “overwhelmingly” passed a ban on fracking. An astounding 78 percent of voters supported the ban.

- Central California’s San Benito County, which lies atop the Monterey Shale formation, passed Measure J to ban fracking, overcoming $1.8 million in spending from Chevron, ExxonMobil, Occidental Petroleum and other oil companies. Supporters of the ban won despite being outspent 15 to one.

- Northern California’s Mendocino County likewise passed Measure S to ban fracking, with 67 percent of the vote. The successful effort was led by the Community Rights Network of Mendocino County, a grassroots group of 30 activists supported by groups such as Californians Against Fracking, Community Environmental Legal Defense Fund, and Global Exchange.

There were additional local victories for oil-industry opponents and environmentalists across the nation.

In Richmond, the San Francisco suburb home to a major Chevron refinery which exploded in 1989, 1999, and 2012, a five-member progressive slate for mayor and city council won decisive victory over the Chevron-supported candidates. The progressives, supported by Richmond Working Families (ACCE Action, APEN Action, SEIU 1021), and by the Richmond Progressive Alliance, overcame $3 million in spending by the oil giant, a 60 to one spending ratio.

Fracking opponent Kristy Pagan, a first-time candidate, won election in Michigan’s state House 21st District.

In one of the few national races to swing unexpectedly for Democrats, Rep. Lee Terry of Nebraska, a major Keystone XL backer, lost to Democratic challenger Brad Ashford, who has also expressed support for the pipeline but was endorsed by the League of Conservation Voters.

In another local victory against industrial interests, a ban on genetically engineered crops in Maui County, Hawaii, narrowly passed, overcoming $8 million in spending from opponents such as Monsanto and Dow, who profit from the treatment of food as intellectual property. The failed opposition outspent advocates 87 to 1. GMO-labeling measures failed under a similar spending onslaught in Colorado and Oregon.

“Their wins aren’t wins just for their communities — they are wins for all of us pushing back against the fossil fuel industry and for a climate safe future,” Oil Change International’s David Turnbull wrote. “They are bright spots in an otherwise dim night.”

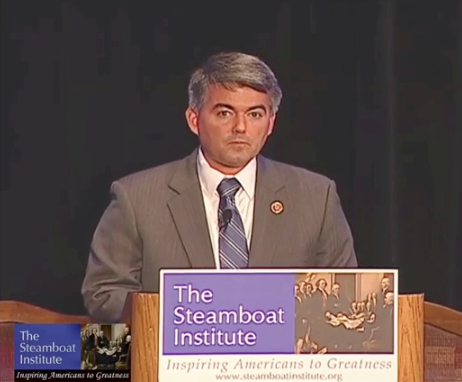

VIDEO: Cory Gardner: "We Have to Stand Up to the Radical Environmentalists"

Speaking at a right-wing conference, Rep. Cory Gardner (R-Colo.) denounced the “radical environmentalists” and “social engineers” who oppose the “individual job creators” who run fossil-fuel companies. Promising the Keystone XL pipeline will get built, Gardner went on to describe his allegiance to the fracking “shale revolution”: “We will rise up, and we will win!”

Rep. Cory Gardner (R-Colo.), now challenging Democrat Mark Udall’s U.S. Senate seat, has run a campaign as a “likeable” moderate.

Dick and Liz Cheney were the featured stars at the Steamboat Institute Freedom Conference, which took place in Steamboat Springs, Colo., on August 23, 2013. Gardner was the first speaker at the conference.

Gardner’s remarks about the “power” of fossil-fuel executives who “realize what is at stake in this country” alludes to the petrochemical billionaire Koch brothers and other campaign contributors.

Gardner is a “long-time friend” of Americans for Prosperity Colorado head Jeff Crank, and is known to have appeared at the Koch’s 2014 summit in California. AFP and the Koch super PAC Freedom Partners have spent over $3 million supporting Gardner’s candidacy, primarily by attacking Udall. Koch Industries is Gardner’s top campaign contributor this cycle. Gardner, who joined Congress in 2011, has raked in $772,000 in campaign contributions from the oil & gas industry.

TRANSCRIPT:

We have to stand up to the radical environmentalists, the social engineers who believe that we must stop. And in Colorado we know that threat is real. We know they’re going to try to stop something that is creating jobs on the eastern plains and the western slope of this great state. We know they’re going to try to say no to the Marcellus, no to the Bakken. They’ve already tried to say no to the Keystone pipeline. But you know what? We know we’re going to win because of the power of our individual job creators. They are right, they are with us. And when the individuals realize what is at stake in this country, we will rise up, and we will win. The shale revolution is real.

Older posts: 1 2