Following days of furious wrangling to fit their multi-trillion-dollar omnibus through budget reconciliation guiderails, the Senate Republican leadership released the full text of their version of the One Big Brutal Bill Act (H.R. 1) at midnight Saturday morning.

The bill’s guiding purpose is to kill the Green New Deal, the sweeping legislative vision of climate, social, and economic justice that President Joe Biden disavowed, even as his Inflation Reduction Act made compromised moves in that direction.

Below is the 13-page, 315-section table of contents for this gargantuan assault on the nation:

TITLE I—COMMITTEE ON AGRICULTURE, NUTRITION, AND FORESTRY

Subtitle A—Nutrition

- Sec. 10101. Re-evaluation of thrifty food plan.

- Sec. 10102. Modifications to SNAP work requirements for able-bodied adults

- Sec. 10103. Availability of standard utility allowances based on receipt of energy assistance.

- Sec. 10104. Restrictions on internet expenses.

- Sec. 10105. Matching funds requirements.

- Sec. 10106. Administrative cost sharing.

- Sec. 10107. National education and obesity prevention grant program.

- Sec. 10108. Alien SNAP eligibility.

Subtitle B—Forestry

- Sec. 10201. Rescission of amounts for forestry.

Subtitle C—Commodities

- Sec. 10301. Effective reference price; reference price.

- Sec. 10302. Base acres.

- Sec. 10303. Producer election.

- Sec. 10304. Price loss coverage.

- Sec. 10305. Agriculture risk coverage.

- Sec. 10306. Equitable treatment of certain entities.

- Sec. 10307. Payment limitations.

- Sec. 10308. Adjusted gross income limitation.

- Sec. 10309. Marketing loans.

- Sec. 10310. Repayment of marketing loans.

- Sec. 10311. Economic adjustment assistance for textile mills.

- Sec. 10312. Sugar program updates.

- Sec. 10313. Dairy policy updates.

- Sec. 10314. Implementation.

Subtitle D—Disaster Assistance Programs

- Sec. 10401. Supplemental agricultural disaster assistance.

Subtitle E—Crop Insurance

- Sec. 10501. Beginning farmer and rancher benefit.

- Sec. 10502. Area-based crop insurance coverage and affordability.

- Sec. 10503. Administrative and operating expense adjustments.

- Sec. 10504. Premium support.

- Sec. 10505. Program compliance and integrity.

- Sec. 10506. Reviews, compliance, and integrity.

- Sec. 10507. Poultry insurance pilot program.

Subtitle F—Additional Investments in Rural America

- Sec. 10601. Conservation.

- Sec. 10602. Supplemental agricultural trade promotion program.

- Sec. 10603. Nutrition.

- Sec. 10604. Research.

- Sec. 10605. Energy.

- Sec. 10606. Horticulture.

- Sec. 10607. Miscellaneous.

TITLE II—COMMITTEE ON ARMED SERVICES

- Sec. 20001. Enhancement of Department of Defense resources for improving the quality of life for military personnel.

- Sec. 20002. Enhancement of Department of Defense resources for shipbuilding.

- Sec. 20003. Enhancement of Department of Defense resources for integrated air and missile defense.

- Sec. 20004. Enhancement of Department of Defense resources for munitions and defense supply chain resiliency.

- Sec. 20005. Enhancement of Department of Defense resources for scaling lowcost weapons into production.

- Sec. 20006. Enhancement of Department of Defense resources for improving the efficiency and cybersecurity of the Department of Defense.

- Sec. 20007. Enhancement of Department of Defense resources for air superiority.

- Sec. 20008. Enhancement of resources for nuclear forces.

- Sec. 20009. Enhancement of Department of Defense resources to improve capabilities of United States Indo Pacific Command.

- Sec. 20010. Enhancement of Department of Defense resources for improving the readiness of the Department of Defense.

- Sec. 20011. Improving Department of Defense border support and counterdrug missions.

- Sec. 20012. Department of Defense oversight.

- Sec. 20013. Military construction projects authorized.

- Sec. 20014. Multi-year operational plan.

TITLE III—COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS

- Sec. 30001. Funding cap for the Bureau of Consumer Financial Protection.

- Sec. 30002. Rescission of funds for Green and Resilient Retrofit Program for Multifamily Housing.

- Sec. 30003. Securities and Exchange Commission Reserve Fund.

- Sec. 30004. Appropriations for Defense Production Act.

TITLE IV—COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION

- Sec. 40001. Coast Guard mission readiness.

- Sec. 40002. Spectrum auctions.

- Sec. 40003. Air traffic control improvements.

- Sec. 40004. Space launch and reentry licensing and permitting user fees.

- Sec. 40005. Mars missions, Artemis missions, and Moon to Mars program.

- Sec. 40006. Corporate average fuel economy civil penalties.

- Sec. 40007. Payments for lease of Metropolitan Washington Airports.

- Sec. 40008. Rescission of certain amounts for the National Oceanic and Atmospheric Administration.

- Sec. 40009. Reduction in annual transfers to Travel Promotion Fund.

- Sec. 40010. Treatment of unobligated funds for alternative fuel and low-emission aviation technology.

- Sec. 40011. Rescission of amounts appropriated to Public Wireless Supply Chain Innovation Fund.

- Sec. 40012. Support for artificial intelligence under the Broadband Equity, Access, and Deployment Program.

TITLE V—COMMITTEE ON ENERGY AND NATURAL RESOURCES

Subtitle A—Oil and Gas Leasing

- Sec. 50101. Onshore oil and gas leasing.

- Sec. 50102. Offshore oil and gas leasing.

- Sec. 50103. Royalties on extracted methane.

- Sec. 50104. Alaska oil and gas leasing.

- Sec. 50105. National Petroleum Reserve–Alaska.

Subtitle B—Mining

- Sec. 50201. Coal leasing.

- Sec. 50202. Coal royalty.

- Sec. 50203. Leases for known recoverable coal resources.

- Sec. 50204. Authorization to mine Federal coal.

Subtitle C—Lands

- Sec. 50301. Mandatory disposal of Bureau of Land management land for housing.

- Sec. 50302. Timber sales and long-term contracting for the Forest Service and the Bureau of Land Management.

- Sec. 50303. Renewable energy fees on Federal land.

- Sec. 50304. Renewable energy revenue sharing.

- Sec. 50305. Rescission of National Park Service and Bureau of Land Management funds.

- Sec. 50306. Celebrating America’s 250th anniversary.

Subtitle D—Energy

- Sec. 50401. Strategic Petroleum Reserve.

- Sec. 50402. Repeals; rescissions.

- Sec. 50403. Energy dominance financing.

- Sec. 50404. Transformational artificial intelligence models.

Subtitle E—Water

- Sec. 50501. Water conveyance and surface water storage enhancement.

TITLE VI—COMMITTEE ON ENVIRONMENT AND PUBLIC WORKS

- Sec. 60001. Rescission of funding for clean heavy-duty vehicles.

- Sec. 60002. Repeal of Greenhouse Gas Reduction Fund.

- Sec. 60003. Rescission of funding for diesel emissions reductions.

- Sec. 60004. Rescission of funding to address air pollution.

- Sec. 60005. Rescission of funding to address air pollution at schools.

- Sec. 60006. Rescission of funding for the low emissions electricity program.

- Sec. 60007. Rescission of funding for section 211(o) of the Clean Air Act.

- Sec. 60008. Rescission of funding for implementation of the American Innovation and Manufacturing Act.

- Sec. 60009. Rescission of funding for enforcement technology and public information.

- Sec. 60010. Rescission of funding for greenhouse gas corporate reporting.

- Sec. 60011. Rescission of funding for environmental product declaration assistance.

- Sec. 60012. Rescission of funding for methane emissions and waste reduction incentive program for petroleum and natural gas systems.

- Sec. 60013. Rescission of funding for greenhouse gas air pollution plans and implementation grants.

- Sec. 60014. Rescission of funding for environmental protection agency efficient, accurate, and timely reviews.

- Sec. 60015. Rescission of funding for low-embodied carbon labeling for construction materials.

- Sec. 60016. Rescission of funding for environmental and climate justice block grants.

- Sec. 60017. Rescission of funding for ESA recovery plans.

- Sec. 60018. Rescission of funding for environmental and climate data collection.

- Sec. 60019. Rescission of neighborhood access and equity grant program.

- Sec. 60020. Rescission of funding for Federal building assistance.

- Sec. 60021. Rescission of funding for low-carbon materials for Federal buildings.

- Sec. 60022. Rescission of funding for GSA emerging and sustainable technologies.

- Sec. 60023. Rescission of environmental review implementation funds.

- Sec. 60024. Rescission of low-carbon transportation materials grants.

- Sec. 60025. John F. Kennedy Center for the Performing Arts.

- Sec. 60026. Project sponsor opt-in fees for environmental reviews.

TITLE VII—FINANCE

Subtitle A—Tax

- Sec. 70001. References to the Internal Revenue Code of 1986, etc.

CHAPTER 1—PROVIDING PERMANENT TAX RELIEF FOR MIDDLE-CLASS FAMILIES AND WORKERS

- Sec. 70101. Extension and enhancement of reduced rates.

- Sec. 70102. Extension and enhancement of increased standard deduction.

- Sec. 70103. Termination of deduction for personal exemptions other than temporary senior deduction.

- Sec. 70104. Extension and enhancement of increased child tax credit.

- Sec. 70105. Extension and enhancement of deduction for qualified business income.

- Sec. 70106. Extension and enhancement of increased estate and gift tax exemption amounts.

- Sec. 70107. Extension of increased alternative minimum tax exemption amounts and modification of phaseout thresholds.

- Sec. 70108. Extension and modification of limitation on deduction for qualified residence interest.

- Sec. 70109. Extension and modification of limitation on casualty loss deduction.

- Sec. 70110. Termination of miscellaneous itemized deductions other than educator expenses.

- Sec. 70111. Limitation on tax benefit of itemized deductions.

- Sec. 70112. Extension and modification of qualified transportation fringe benefits.

- Sec. 70113. Extension and modification of limitation on deduction and exclusion for moving expenses.

- Sec. 70114. Extension and modification of limitation on wagering losses.

- Sec. 70115. Extension and enhancement of increased limitation on contributions to ABLE accounts.

- Sec. 70116. Extension and enhancement of savers credit allowed for ABLE contributions.

- Sec. 70117. Extension of rollovers from qualified tuition programs to ABLE accounts permitted.

- Sec. 70118. Extension of treatment of certain individuals performing services in the Sinai Peninsula and enhancement to include additional areas.

- Sec. 70119. Extension and modification of exclusion from gross income of student loans discharged on account of death or disability.

- Sec. 70120. Limitation on individual deductions for certain state and local taxes, etc.

CHAPTER 2—DELIVERING ON PRESIDENTIAL PRIORITIES TO PROVIDE NEW MIDDLE-CLASS TAX RELIEF

- Sec. 70201. No tax on tips.

- Sec. 70202. No tax on overtime.

- Sec. 70203. No tax on car loan interest.

- Sec. 70204. Trump accounts and contribution pilot program.

CHAPTER 3—ESTABLISHING CERTAINTY AND COMPETITIVENESS FOR AMERICAN JOB CREATORS

SUBCHAPTER A—PERMANENT U.S. BUSINESS TAX REFORM AND BOOSTING DOMESTIC INVESTMENT

- Sec. 70301. Full expensing for certain business property.

- Sec. 70302. Full expensing of domestic research and experimental expenditures.

- Sec. 70303. Modification of limitation on business interest.

- Sec. 70304. Extension and enhancement of paid family and medical leave credit.

- Sec. 70305. Exceptions from limitations on deduction for business meals.

- Sec. 70306. Increased dollar limitations for expensing of certain depreciable business assets.

- Sec. 70307. Special depreciation allowance for qualified production property.

- Sec. 70308. Enhancement of advanced manufacturing investment credit.

- Sec. 70309. Spaceports are treated like airports under exempt facility bond rules.

SUBCHAPTER B—PERMANENT AMERICA-FIRST INTERNATIONAL TAX REFORMS

PART I—FOREIGN TAX CREDIT

- Sec. 70311. Modifications related to foreign tax credit limitation.

- Sec. 70312. Modifications to determination of deemed paid credit for taxes properly attributable to tested income.

- Sec. 70313. Sourcing certain income from the sale of inventory produced in the United States.

PART II—FOREIGN-DERIVED DEDUCTION ELIGIBLE INCOME AND NET CFC TESTED INCOME

- Sec. 70321. Modification of deduction for foreign-derived deduction eligible income and net CFC tested income.

- Sec. 70322. Determination of deduction eligible income.

- Sec. 70323. Rules related to deemed intangible income.

PART III—BASE EROSION MINIMUM TAX

- Sec. 70331. Extension and modification of base erosion minimum tax amount.

PART IV—BUSINESS INTEREST LIMITATION

- Sec. 70341. Coordination of business interest limitation with interest capitalization provisions.

- Sec. 70342. Definition of adjusted taxable income for business interest limitation.

PART V—OTHER INTERNATIONAL TAX REFORMS

- Sec. 70351. Permanent extension of look-thru rule for related controlled foreign corporations.

- Sec. 70352. Repeal of election for 1-month deferral in determination of taxable year of specified foreign corporations.

- Sec. 70353. Restoration of limitation on downward attribution of stock ownership in applying constructive ownership rules.

- Sec. 70354. Modifications to pro rata share rules.

CHAPTER 4—INVESTING IN AMERICAN FAMILIES, COMMUNITIES, AND SMALL BUSINESSES

SUBCHAPTER A—PERMANENT INVESTMENTS IN FAMILIES AND CHILDREN

- Sec. 70401. Enhancement of employer-provided child care credit.

- Sec. 70402. Enhancement of adoption credit.

- Sec. 70403. Recognizing Indian tribal governments for purposes of determining whether a child has special needs for purposes of the adoption credit.

- Sec. 70404. Enhancement of the dependent care assistance program.

- Sec. 70405. Enhancement of child and dependent care tax credit.

SUBCHAPTER B—PERMANENT INVESTMENTS IN STUDENTS AND REFORMS TO TAX-EXEMPT INSTITUTIONS

- Sec. 70411. Tax credit for contributions of individuals to scholarship granting organizations.

- Sec. 70412. Exclusion for employer payments of student loans.

- Sec. 70413. Additional expenses treated as qualified higher education expenses for purposes of 529 accounts.

- Sec. 70414. Certain postsecondary credentialing expenses treated as qualified higher education expenses for purposes of 529 accounts.

- Sec. 70415. Modification of excise tax on investment income of certain private colleges and universities.

- Sec. 70416. Expanding application of tax on excess compensation within taxexempt organizations.

SUBCHAPTER C—PERMANENT INVESTMENTS IN COMMUNITY DEVELOPMENT

- Sec. 70421. Permanent renewal and enhancement of opportunity zones.

- Sec. 70422. Permanent enhancement of low-income housing tax credit.

- Sec. 70423. Permanent extension of new markets tax credit.

- Sec. 70424. Permanent and expanded reinstatement of partial deduction for charitable contributions of individuals who do not elect to itemize.

- Sec. 70425. 0.5 percent floor on deduction of contributions made by individuals.

- Sec. 70426. 1-percent floor on deduction of charitable contributions made by corporations.

- Sec. 70427. Permanent increase in limitation on cover over of tax on distilled spirits.

- Sec. 70428. Nonprofit community development activities in remote native villages.

- Sec. 70429. Adjustment of charitable deduction for certain expenses incurred in support of Native Alaskan subsistence whaling.

- Sec. 70430. Exception to percentage of completion method of accounting for certain residential construction contracts.

SUBCHAPTER D—PERMANENT INVESTMENTS IN SMALL BUSINESS AND RURAL AMERICA

- Sec. 70431. Expansion of qualified small business stock gain exclusion.

- Sec. 70432. Repeal of revision to de minimis rules for third party network transactions.

- Sec. 70433. Increase in threshold for requiring information reporting with respect to certain payees.

- Sec. 70434. Treatment of certain qualified sound recording productions.

- Sec. 70435. Exclusion of interest on loans secured by rural or agricultural real property.

- Sec. 70436. Reduction of transfer and manufacturing taxes for certain devices.

- Sec. 70437. Treatment of capital gains from the sale of certain farmland property.

- Sec. 70438. Extension of rules for treatment of certain disaster-related personal casualty losses.

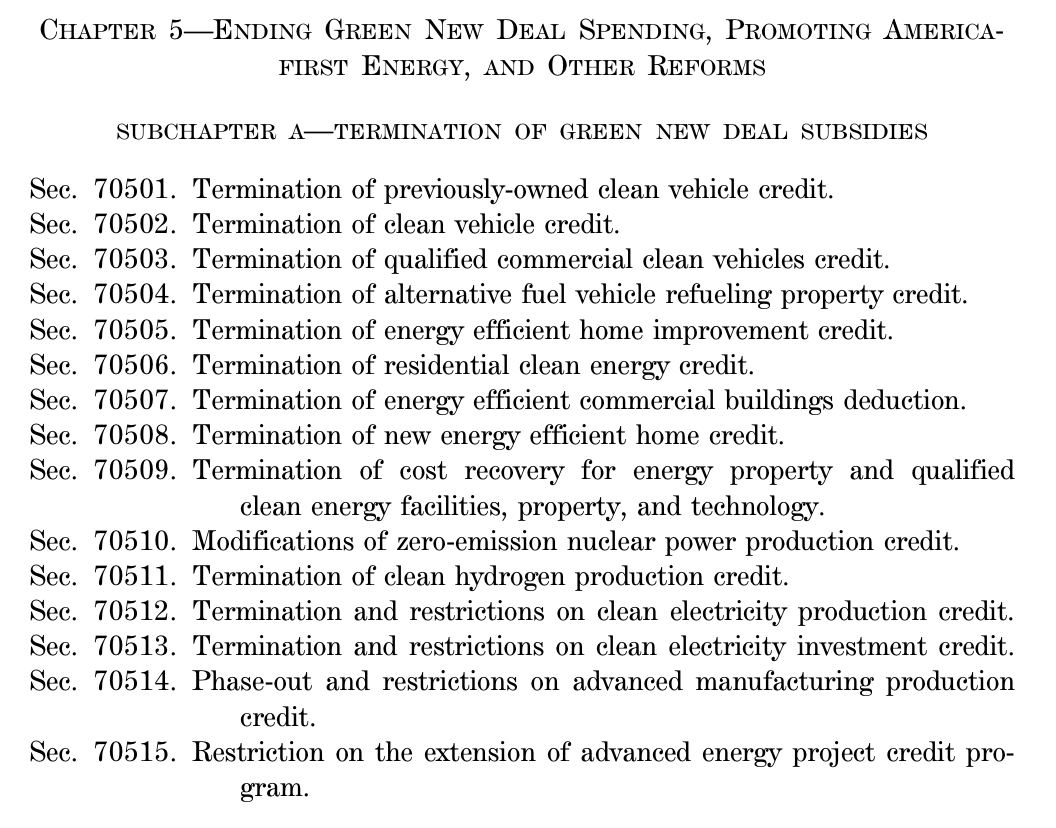

CHAPTER 5—ENDING GREEN NEW DEAL SPENDING, PROMOTING AMERICAFIRST ENERGY, AND OTHER REFORMS

SUBCHAPTER A—TERMINATION OF GREEN NEW DEAL SUBSIDIES

- Sec. 70501. Termination of previously-owned clean vehicle credit.

- Sec. 70502. Termination of clean vehicle credit.

- Sec. 70503. Termination of qualified commercial clean vehicles credit.

- Sec. 70504. Termination of alternative fuel vehicle refueling property credit.

- Sec. 70505. Termination of energy efficient home improvement credit.

- Sec. 70506. Termination of residential clean energy credit.

- Sec. 70507. Termination of energy efficient commercial buildings deduction.

- Sec. 70508. Termination of new energy efficient home credit.

- Sec. 70509. Termination of cost recovery for energy property and qualified clean energy facilities, property, and technology.

- Sec. 70510. Modifications of zero-emission nuclear power production credit.

- Sec. 70511. Termination of clean hydrogen production credit.

- Sec. 70512. Termination and restrictions on clean electricity production credit.

- Sec. 70513. Termination and restrictions on clean electricity investment credit.

- Sec. 70514. Phase-out and restrictions on advanced manufacturing production credit.

- Sec. 70515. Restriction on the extension of advanced energy project credit program.

SUBCHAPTER B—ENHANCEMENT OF AMERICA-FIRST ENERGY POLICY

- Sec. 70521. Extension and modification of clean fuel production credit.

- Sec. 70522. Restrictions on carbon oxide sequestration credit.

- Sec. 70523. Intangible drilling and development costs taken into account for purposes of computing adjusted financial statement income.

- Sec. 70524. Income from hydrogen storage, carbon capture, advanced nuclear, hydropower, and geothermal energy added to qualifying income of certain publicly traded partnerships

- Sec. 70525. Allow for payments to certain individuals who dye fuel.

SUBCHAPTER C—OTHER REFORMS

- Sec. 70531. Modifications to de minimis entry privilege for commercial shipments.

CHAPTER 6—ENHANCING DEDUCTION AND INCOME TAX CREDIT GUARDRAILS, AND OTHER REFORMS

- Sec. 70601. Modification and extension of limitation on excess business losses of noncorporate taxpayers.

- Sec. 70602. Treatment of payments from partnerships to partners for property or services.

- Sec. 70603. Excessive employee remuneration from controlled group members and allocation of deduction.

- Sec. 70604. Third party litigation funding reform.

- Sec. 70605. Excise tax on certain remittance transfers.

- Sec. 70606. Enforcement provisions with respect to COVID-related employee retention credits.

- Sec. 70607. Social security number requirement for American Opportunity and Lifetime Learning credits.

- Sec. 70608. Task force on the replacement of Direct File.

Subtitle B—Health

CHAPTER 1—MEDICAID

SUBCHAPTER A—REDUCING FRAUD AND IMPROVING ENROLLMENT PROCESSES

- Sec. 71101. Moratorium on implementation of rule relating to eligibility and enrollment in Medicare Savings Programs.

- Sec. 71102. Moratorium on implementation of rule relating to eligibility and enrollment for Medicaid, CHIP, and the Basic Health Program.

- Sec. 71103. Reducing duplicate enrollment under the Medicaid and CHIP programs.

- Sec. 71104. Ensuring deceased individuals do not remain enrolled.

- Sec. 71105. Ensuring deceased providers do not remain enrolled.

- Sec. 71106. Payment reduction related to certain erroneous excess payments under Medicaid.

- Sec. 71107. Eligibility redeterminations.

- Sec. 71108. Revising home equity limit for determining eligibility for long-term care services under the Medicaid program.

- Sec. 71109. Alien Medicaid eligibility.

- Sec. 71110. Expansion FMAP for certain States providing payments for health care furnished to certain individuals.

- Sec. 71111. Expansion FMAP for emergency Medicaid.

SUBCHAPTER B—PREVENTING WASTEFUL SPENDING

- Sec. 71112. Moratorium on implementation of rule relating to staffing standards for long-term care facilities under the Medicare and Medicaid programs.

- Sec. 71113. Reducing State Medicaid costs.

- Sec. 71114. Prohibiting Federal Medicaid and CHIP funding for certain items and services.

- Sec. 71115. Federal payments to prohibited entities.

SUBCHAPTER C—STOPPING ABUSIVE FINANCING PRACTICES

- Sec. 71116. Sunsetting increased FMAP incentive.

- Sec. 71117. Provider taxes.

- Sec. 71118. State directed payments.

- Sec. 71119. Requirements regarding waiver of uniform tax requirement for Medicaid provider tax.

- Sec. 71120. Requiring budget neutrality for Medicaid demonstration projects under section 1115.

SUBCHAPTER D—INCREASING PERSONAL ACCOUNTABILITY

- Sec. 71121. Requirement for States to establish Medicaid community engagement requirements for certain individuals.

- Sec. 71122. Modifying cost sharing requirements for certain expansion individuals under the Medicaid program.

SUBCHAPTER E—EXPANDING ACCESS TO CARE

- Sec. 71123. Making certain adjustments to coverage of home or communitybased services under Medicaid.

- Sec. 71124. Determination of FMAP for high-poverty States.

CHAPTER 2—MEDICARE

SUBCHAPTER A—STRENGTHENING ELIGIBILITY REQUIREMENTS

- Sec. 71201. Limiting Medicare coverage of certain individuals.

SUBCHAPTER B—IMPROVING SERVICES FOR SENIORS

- Sec. 71202. Temporary payment increase under the medicare physician fee schedule to account for exceptional circumstances.

- Sec. 71203. Expanding and clarifying the exclusion for orphan drugs under the Drug Price Negotiation Program.

- Sec. 71204. Application of cost-of-living adjustment to non-labor related portion for hospital outpatient department services furnished in Alaska and Hawaii.

CHAPTER 3—HEALTH TAX

SUBCHAPTER A—IMPROVING ELIGIBILITY CRITERIA

- Sec. 71301. Permitting premium tax credit only for certain individuals.

- Sec. 71302. Disallowing premium tax credit during periods of medicaid ineligibility due to alien status.

SUBCHAPTER B—PREVENTING WASTE, FRAUD, AND ABUSE

- Sec. 71303. Requiring verification of eligibility for premium tax credit.

- Sec. 71304. Disallowing premium tax credit in case of certain coverage enrolled in during special enrollment period.

- Sec. 71305. Eliminating limitation on recapture of advance payment of premium tax credit.

SUBCHAPTER C—ENHANCING CHOICE FOR PATIENTS

- Sec. 71306. Permanent extension of safe harbor for absence of deductible for telehealth services.

- Sec. 71307. Allowance of bronze and catastrophic plans in connection with health savings accounts.

- Sec. 71308. Treatment of direct primary care service arrangements.

CHAPTER 4—PROTECTING RURAL HOSPITALS AND PROVIDERS

- Sec. 71401. Rural Health Transformation Program.

Subtitle C—Increase in Debt Limit

- Sec. 72001. Modification of limitation on the public debt.

TITLE VIII—COMMITTEE ON HEALTH, EDUCATION, LABOR, AND PENSIONS

Subtitle A—Exemption of Certain Assets

- Sec. 80001. Exemption of certain assets.

Subtitle B—Loan Limits

- Sec. 81001. Establishment of loan limits for graduate and professional students and parent borrowers; termination of graduate and professional PLUS loans.

Subtitle C—Loan Repayment

- Sec. 82001. Loan repayment.

- Sec. 82002. Deferment; forbearance.

- Sec. 82003. Loan rehabilitation.

- Sec. 82004. Public service loan forgiveness.

- Sec. 82005. Student loan servicing.

Subtitle D—Pell Grants

- Sec. 83001. Eligibility.

- Sec. 83002. Workforce Pell Grants.

- Sec. 83003. Pell shortfall.

- Sec. 83004. Federal Pell Grant exclusion relating to other grant aid.

Subtitle E—Accountability

- Sec. 84001. Ineligibility based on low earning outcomes.

Subtitle F—Regulatory Relief

- Sec. 85001. Delay of rule relating to borrower defense to repayment.

- Sec. 85002. Delay of rule relating to closed school discharges.

Subtitle G—Limitation on Authority

- Sec. 86001. Limitation on proposing or issuing regulations and executive actions.

Subtitle H—Garden of Heroes

- Sec. 87001. Garden of Heroes.

- Sec. 88001. Potential sponsor vetting for unaccompanied alien children appropriation.

TITLE IX—COMMITTEE ON HOMELAND SECURITY AND GOVERNMENTAL AFFAIRS

Subtitle A—Homeland Security Provisions

- Sec. 90001. Border infrastructure and wall system.

- Sec. 90002. U.S. Customs and Border Protection personnel, fleet vehicles, and facilities.

- Sec. 90003. Detention capacity.

- Sec. 90004. Border security, technology, and screening.

- Sec. 90005. State and local assistance.

- Sec. 90006. Presidential residence protection.

- Sec. 90007. Department of Homeland Security appropriations for border support.

Subtitle B—Governmental Affairs Provisions

- Sec. 90101. FEHB improvements.

- Sec. 90102. Pandemic Response Accountability Committee.

- Sec. 90103. Appropriation for the Office of Management and Budget.

TITLE X—COMMITTEE ON THE JUDICIARY

Subtitle A—Immigration and Law Enforcement Matters

PART I—IMMIGRATION FEES

- Sec. 100001. Applicability of the immigration laws.

- Sec. 100002. Asylum fee.

- Sec. 100003. Employment authorization document fees.

- Sec. 100004. Immigration parole fee.

- Sec. 100005. Special immigrant juvenile fee.

- Sec. 100006. Temporary protected status fee.

- Sec. 100007. Visa integrity fee.

- Sec. 100008. Form I–94 fee.

- Sec. 100009. Annual asylum fee.

- Sec. 100010. Fee relating to renewal and extension of employment authorization for parolees.

- Sec. 100011. Fee relating to renewal or extension of employment authorization for asylum applicants.

- Sec. 100012. Fee relating to renewal and extension of employment authorization for aliens granted temporary protected status.

- Sec. 100013. Fees relating to applications for adjustment of status.

- Sec. 100014. Electronic System for Travel Authorization fee.

- Sec. 100015. Electronic Visa Update System fee.

- Sec. 100016. Fee for aliens ordered removed in absentia.

- Sec. 100017. Inadmissible alien apprehension fee.

- Sec. 100018. Amendment to authority to apply for asylum.

PART II—IMMIGRATION AND LAW ENFORCEMENT FUNDING

- Sec. 100051. Appropriation for the Department of Homeland Security.

- Sec. 100052. Appropriation for U.S. Immigration and Customs Enforcement.

- Sec. 100053. Appropriation for Federal Law Enforcement Training Centers.

- Sec. 100054. Appropriation for the Department of Justice.

- Sec. 100055. Bridging Immigration-related Deficits Experienced Nationwide Reimbursement Fund.

- Sec. 100056. Appropriation for the Bureau of Prisons.

- Sec. 100057. Appropriation for the United States Secret Service.

Subtitle B—Judiciary Matters

- Sec. 100101. Appropriation to the Administrative Office of the United States Courts.

- Sec. 100102. Appropriation to the Federal Judicial Center.

Subtitle C—Radiation Exposure Compensation Matters

- Sec. 100201. Extension of fund.

- Sec. 100202. Claims relating to atmospheric testing.

- Sec. 100203. Claims relating to uranium mining.

- Sec. 100205. Limitations on claims.