Draft Text of Coronavirus Bailout Bill: "This Is A Robbery In Progress."

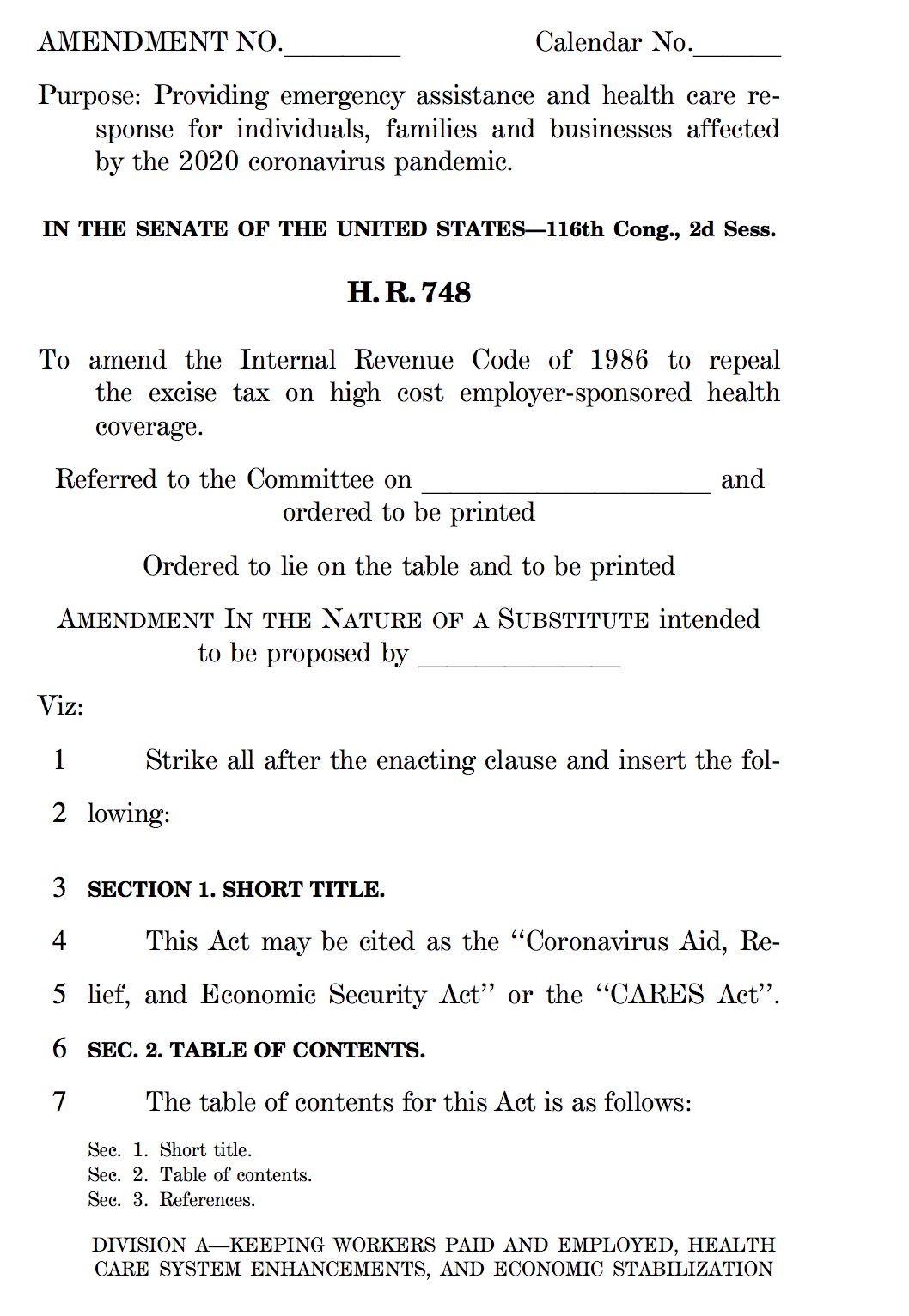

Senate leadership is nearing completion of the Coronavirus Aid, Relief, and Economic Security Act, a staggeringly large stimulus and bailout package that is intended not to protect the American people during the COVID-19 pandemic but to transfer even more money and power to the corporate elite.

Senate leadership is nearing completion of the Coronavirus Aid, Relief, and Economic Security Act, a staggeringly large stimulus and bailout package that is intended not to protect the American people during the COVID-19 pandemic but to transfer even more money and power to the corporate elite.

David Dayen writes: “This is a robbery in progress. And it’s not a bailout for the coronavirus. It’s a bailout for twelve years of corporate irresponsibility that made these companies so fragile that a few weeks of disruption would destroy them. The short-termism and lack of capital reserves funneled record profits into a bathtub of cash for investors. That’s who’s being made whole, financiers and the small slice of the public that owns more than a trivial amount of stocks. In fact they’ve already been made whole; yesterday Wall Street got the word that they’d be saved and stocks and bonds went wild. BlackRock, the world’s largest asset manager, is running these bailout programs for the Fed, and could explicitly profit if the Fed buys its funds, which it probably will.

This is a rubber-stamp on an unequal system that has brought terrible hardship to the majority of America. The people get a $1,200 means-tested payment and a little wage insurance for four months. Corporations get a transformative amount of play money to sustain their system and wipe out the competition.”

Jeff Hauser: “Democratic leaders acceding to a Mnuchin managed slush fund reveal themselves to be too tired and spineless to be entrusted with power.”

Matt Stoller: “Not one political leader is standing up against the Schumer-McConnell shift of power to Wall Street. No one on the populist left, neither Bernie Sanders or Elizabeth Warren. No one on the populist right, not Josh Hawley or Tom Cotton. This was their moment.”

More Stoller, from his newsletter BIG: “Here’s why the bill goes up in value to $6-10 trillion:

- An additional $4 trillion from the Federal Reserve in lending power to be lent to big corporations and banks.

- Authorization to bail out money market funds, multi-trillion dollar unregulated bank-like deposits for the superrich.

- Authorization for the the government through the Federal Deposit Insurance Corporation to guarantee trillions of dollars of risky bank debt.”