Climate-Related Disclosures

The meeting will be webcast on the Commission’s website at www.sec.gov.

MATTERS TO BE CONSIDERED:

The Commission will consider whether to propose amendments that would enhance and standardize registrants’ climate-related disclosures for investors.

CONTACT PERSON FOR MORE INFORMATION: For further information and to ascertain what, if any, matters have been added, deleted or postponed, please contact Vanessa A. Countryman from the Office of the Secretary at (202) 551-5400

Toxic Money: Wall Street’s Trillion Dollar Gamble With our Economy and Planet

- Sharon Lavigne, Founder of RISE St. James and 2021 Goldman Prize Recipient North America

- Lisa Anne Hamilton, Attorney and Climate Law and Policy Consultant and former Adaptation Program Director for the Georgetown Climate Center

- Tracey Lewis, Policy Counsel at Public Citizen (moderator)

This event was organized by Action Center on Race and the Economy, Americans for Financial Reform Education Fund, Positive Money US, Public Citizen, Stop the Money Pipeline, and The Sunrise Project.

Wall Street's Carbon Bubble

During the U.N. Climate Change Conference (COP26), financial institutions and governments all over the world made unprecedented pledges and commitments to reduce financed emissions and begin to address climate-related financial risk. Now that the dust has settled, the real work of implementing these commitments begins. What will this mean for the Biden administration? Will President Joe Biden’s financial regulators endeavor to reign in banks and other financial institutions that continue to fund fossil fuels and other high-carbon-emitting industries or leave the U.S. economy and financial system at risk of another crisis?

Please join the Center for American Progress and Sierra Club for the launch of important new research revealing the enormous size of carbon emissions financed by the largest banks and asset managers in the United States and a discussion of actions the Biden administration can take to curtail this problem before the carbon bubble bursts.

Speakers:- Caroline A. Crenshaw, Commissioner, U.S. Securities and Exchange

- Rep. Rashida Tlaib (D-Mich.)

- Sen. Jeff Merkley (D-Ore.)

- John Podesta, Founder and Chair of the Board of Directors, Center for American Progress

- Ben Cushing, Campaign Director for Fossil-Free Finance, Sierra Club

21st Century Economy: Protecting the Financial System from Risks Associated with Climate Change

- Gregory Gelzinis, Associate Director For Economic Policy, Center for American Progress

- Dr. Nathaniel Keohane, Senior Vice President, Climate, Environmental Defense Fund

- Marilyn Waite, Climate and Clean Energy Finance Program Officer, The William and Flora Hewlett Foundation Republican witnesses

- Dr. John Cochrane, Senior Fellow, Hoover Institution, Stanford University

- Dr. Benjamin Zycher, Resident Scholar, American Enterprise Institute

Climate Change and Social Responsibility: Helping Corporate Boards and Investors Make Decisions for a Sustainable World

- H.R. 1087, the Shareholder Political Transparency Act of 2021

- the Disclosure of Tax Havens and Offshoring Act

- the Climate Risk Disclosure Act

- the Greater Accountability in Pay Act

- the Improving Corporate Governance Through Diversity Act of 2021

- the Paris Climate Agreement Disclosure Act

- the Oil and Minerals Corruption Prevention Act

- Andy Green, Senior Fellow for Economic Policy, Center for American Progress

- Heather McTeer Toney, Environmental Justice Liaison, Environmental Defense Fund and Senior Advisor, Moms Clear Air Force

- Veena Ramani, Senior Program director, Capital Market Systems, Ceres

- James Andrus, Investment Manager, California Public Employees’ Retirement System

- Vivek Ramaswamy, Biotech Entrepreneur and Author

Sen. Chuck Schumer (D-N.Y.) at the People's Climate March: "We Have to Stop CO2 From Hurtling Into the Atmosphere"

Taking part in the largest climate march in history, Sen. Chuck Schumer (D-N.Y.) said that Wall Street bankers will only act on climate change if people organize to make them do so. He also expressed succinctly the climate-policy challenge: “We have to stop CO2 from hurtling into the atmosphere.”

During the PeoplesClimate.tv livestream of the People’s Climate March, Hill Heat’s Brad Johnson caught up with Schumer as he chatted with billionaire climate activist Tom Steyer. The senator said that action from pension funds is needed to get Wall Street to stop financing fossil fuels, because the bankers will not lead.

“The leadership has to come from the people,” Schumer told me. “Pension funds could do a lot.”

Wall Street plays a tremendous role making New York one of the richest cities in the world. It drives the global economy, which is powered on fossil fuels. Even as Mayor DeBlasio is working to decarbonize the city’s energy supply, carbon financier David Koch is the richest man in the city. Meaningful global action on climate change, the type Schumer called for, will require Wall Street to fully divest from financing the fossil-fuel industry. Although pension-fund and other private action is helpful, what is truly needed is legislative action from Congress.

PeoplesClimate.tv is a project of Act.tv, the web video activism site.

Transcript:

SCHUMER: We need to stop CO2 from hurtling into the atmosphere. We need do it, we need to work for climate change both globally and locally. Globally, the whole UN is here. Globally, all the leaders of the the world should get together and maybe begin raising consciousness and doing so. Locally, we have to act on our own. We can’t wait for the leaders of the world. Today Mayor DeBlasio did a very good thing by saying he’s going to greatly increase the efficiency of buildings. That’s important.Q: A lot of people are saying that leaders need to be the first ones to step up. What are you planning to do?

SCHUMER: I’ve been a leader of these things in Congress for a long time. But anybody in New York who doubted the effects of climate change changed their minds after Sandy.

. . .

BRAD JOHNSON: This is the richest city, perhaps in the world. Wall Street plays a tremendous role. It drives the global economy. Right now the global economy is powered on fossil fuels. How can finance, how can Wall Street change the tide?

SCHUMER: Well, one of the ways there’s leverage on Wall Street are pension funds, from the states, from the unions, and others. And if they say some things, sometimes Wall Street listens.

JOHNSON: Do you think there’s going to be leadership from the world of the banks, the bankers?

SCHUMER: No. The leadership has to come from the people, but as I said, pension funds could do a lot. He [Tom Steyer] knows a lot more about this than me.

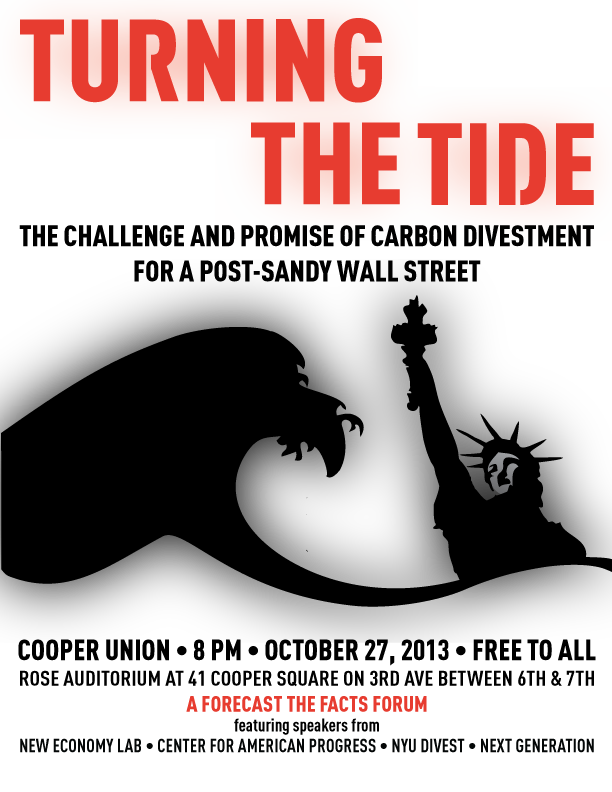

Turning The Tide: Carbon Divestment for a Post-Sandy Wall Street

In the New York City region, Sandy helped to mobilize a very necessary, overdue conversation on climate survival, but the politics and economics of ending climate pollution — specifically divesting from the fossil fuel industries — has still largely been ignored.

In the New York City region, Sandy helped to mobilize a very necessary, overdue conversation on climate survival, but the politics and economics of ending climate pollution — specifically divesting from the fossil fuel industries — has still largely been ignored.

The forum, webcast live, will confront the challenge that Wall Street faces in its financing of the pollution that is threatening New York City’s future. We will also tackle this thorny question: Why is David H. Koch, NYC’s richest man, one of the people most responsible for blocking US climate action?

- Moderator: Brad Johnson, Forecast the Facts - James Slezak, founder of the New Economy Lab - Kate Gordon, VP and Director, Energy and Climate, Next Generation - Bracken Hendricks, Senior Fellow, Center for American Progress - Sophie Lasoff, founder of NYU Divest

This forum follows the afternoon’s Turn the Tide on Sandy! rally at City Hall, organized by the Alliance for a Just Rebuilding.

8 PM at Cooper Union’s Rose Auditorium in New York City. RSVP here.

Happy Hour: Making Finance Sustainable

Please come to the inaugural Hill Heat Happy Hour at the Reef in Adams Morgan, to drink Manhattans and discuss Copenhagen, and mix beers with biochar. Our special guest speaker will be Jerome Guillet, a top wind energy financier and sustainable energy blogger. In a brief presentation, Making Finance Sustainable, Jerome will discuss how to avoid another global financial meltdown and what barriers exist to the financing of the renewable energy sector.

Jerome Guillet is a French investment banker based in Paris, specializing in the energy sector, and more specifically on wind power. He blogs as “Jerome a Paris” on DailyKos and other sites and is editor of the European Tribune (www.eurotrib.com), a website and European politics and international affairs, and contributing editor to The Oil Drum (www.theoildrum.com), a website focused on energy. He’s also a member of the “Energize America” Netroots effort to draft a sane energy policy.

The Reef

2446 18th St NW

Washington, DC 20009

Come to the Inaugural Hill Heat Happy Hour with Jerome Guillet

Please come to the inaugural Hill Heat Happy Hour at the Reef in Adams Morgan Monday afternoon at 6:30, to drink Manhattans and discuss Copenhagen, and mix beers with biochar. Our special guest speaker will be Jerome Guillet, a top wind energy financier and sustainable energy blogger. In a brief presentation, Making Finance Sustainable, Jerome will discuss how to avoid another global financial meltdown and what barriers exist to the financing of the renewable energy sector. Raise your spirits while you raise your glass, and share ideas while you share a pitcher.

Jerome Guillet is a French investment banker based in Paris, specializing in the energy sector, and more specifically on wind power. He blogs as “Jerome a Paris” on DailyKos and other sites and is editor of the European Tribune (www.eurotrib.com), a website and European politics and international affairs, and contributing editor to The Oil Drum (www.theoildrum.com), a website focused on energy. He’s also a member of the “Energize America” Netroots effort to draft a sane energy policy.

Carbon Market Insights Americas 2008

Carbon Market Insights Americas 2008 Day 3

8:00am Registration Open

9:00am – 12:00pm Modeling & Forecasting Carbon Prices (Advanced)

This workshop will present various approaches used to forecast carbon prices, in Europe and North America.- Advantages and disadvantages of macro- and micro-economic models

- The role of time in forecasting carbon prices

- Integrating sectors in multi-sector models

- Modeling the supply of offsets

9:00am – 12:00pm Valuation of CDM Projects & Portfolios (Intermediate)

The Price is Right: Assessing Risk and Value in the Clean Development Mechanism- Understanding political and country risks

- Price and volume risk in CDM offset contracts

- Valuation of carbon assets – state of the art tools and methodologies

Description

Clean Development Mechanism (CDM) projects present many opportunities for investors and project developers who understand the risks and opportunities embedded in the project cycle. Point Carbon presents its unique expertise on CDM projects around the world and its award-winning Carbon Valuation Tool, a web-based tool for valuation and benchmarking of CDM and JI projects and portfolios.

9:00am – 12:00pm Carbon Finance 2.0 (Advanced)

Trading in options on European Union *Allowances: liquidity, prices and pitfalls- Structured offset products: how to tailor offset products to customer’s risk appetite?

- Bidding strategies in carbon auctions

Description

Back by popular demand, Carbon Finance 2.0 will be presented by Point Carbon jointly with key carbon market experts. The workshop will provide cutting edge analysis on the latest financial structures developed to manage the risks in these markets.

9:00am – 12:00pm The New Offset Landscape: North American Demand, Agriculture & Forestry (Introductory)

Greenhouse gas reduction projects in North America- Offsets from agriculture and forestry

- The role of offsets under a future cap-and-trade program

Description

This workshop will get into the details of greenhouse gas emissions reduction projects in North America. We will discuss emerging trends in offset types and protocols, especially in forestry and agriculture. Participants will learn what types of emission credits are generated, as well as how they are verified and marketed. We will hear from some of the key players in the North American offset market on preparing for the role of offsets under a future cap-and-trade system.

Marriott Wardman Park Hotel

Older posts: 1 2