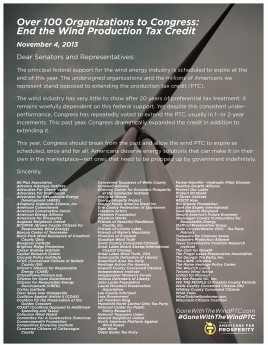

Several

organizations sponsored by Internet giant Google are calling on Congress

to let the wind production tax credit to expire. A full-page

advertisement from the Koch brothers

organization Americans for Prosperity states that the “undersigned

organizations and the millions of Americans we represent stand opposed

to extending the production tax credit (PTC)” because the “wind industry

has very little to show after 20 years of preferential tax treatment.”

Several

organizations sponsored by Internet giant Google are calling on Congress

to let the wind production tax credit to expire. A full-page

advertisement from the Koch brothers

organization Americans for Prosperity states that the “undersigned

organizations and the millions of Americans we represent stand opposed

to extending the production tax credit (PTC)” because the “wind industry

has very little to show after 20 years of preferential tax treatment.”

“Americans deserve energy solutions that can make it on their own in the marketplace — not ones that need to be propped up by government indefinitely,” the letter concludes.

Signatories of the letter who are Google-sponsored organizations, according to Google’s public policy transparency page, include:

- American Conservative Union

- Competitive Enterprise Institute

- Heritage Action For America

- National Taxpayers Union

- R Street Institute

Google’s public policy division, which chose to sponsor the above groups, is run by former Republican Congresswoman Susan Molinari.

In addition to Americans for Prosperity, other signatories notorious for promoting climate-change denial and attacks on climate scientists include the Committee for a Constructive Tomorrow (CFACT), Cornwall Alliance, Freedom Works, Independent Women’s Forum, Club for Growth, and the American Energy Alliance.

The listed organizations are not the only Google-supported opponents of wind power. This year, Google joined the American Legislative Exchange Council (ALEC), whose energy agenda is driven by Koch Industries and other fossil-fuel companies. ALEC’s vigorous campaign against state-level renewable energy standards led to the resignation of the American Wind Energy Association and the Solar Energy Industries Association, who had been members in ALEC until this year. Google only updated its public policy transparency page to include its membership in ALEC recently, months after the first reports in August of its membership.

Google is a major beneficiary of the wind PTC, as the company has the stated goal of “100% renewable energy” power for its operations, which include energy-intensive data centers across the nation. Google currently is the sole customer of the entire output of three different wind farms — NextEra’s 114-megawatt Story County II wind farm in Iowa, NextEra’s 100.8MW Minco II wind farm in Oklahoma, and Chermac Energy’s planned 239.2 MW Happy Hereford wind farm in Amarillo, Tex. Breaking Energy’s Glenn Schleede has estimated that Google will receive a $370 to $417 million benefit from the PTC over ten years if it is continued.

If the PTC expires, Google shareholders will suffer, as will the nation’s growing wind industry. Moreover, the effort to meet the challenge of eliminating greenhouse pollution will be stalled, as the fossil-fuel industry enjoys the benefits of not having to pay for the costs of its civilization-threatening pollution. Climate and corporate accountability groups Forecast the Facts and SumOfUs have called on Google to end its support for politicians and groups that reject the threat of climate change and oppose clean-energy policy.

Google has not responded to requests for comment.

Update: The fossil-fuel industry group American Energy Alliance’s Press Secretary Chris Warren has notified Hill Heat of an error in the originally published letter. The original list included “Parker Hannifin – Hydraulic Filter Division” in the list of supporting organizations. The corrected letter replaces that group with the “Interstate Informed Citizens Coalition.”